To analyze the application of blockchain in the financial field, we should first consider the macro level of the financial system. Starting from the current financial system architecture, analyze the specific impact of blockchain on each component of the financial system, and study the overall trend of blockchain application in the financial field. Based on the application of blockchain in the issuance and circulation of financial asset equity certificates, the blockchain will bring potential positive impacts to the financial system through “one rise, one drop, three innovations”.

From the perspective of practical application, the earliest and hottest application of blockchain is the encrypted digital token. Encrypted digital tokens represented by Bitcoin have innovatively realized the remote point-to-point circulation of asset rights based on blockchain, and gradually stimulated people’s discussion on the application of blockchain in currency issuance and circulation. This is the first “innovation”. Based on the innovative application of the electronic and point-to-point circulation of encrypted digital tokens and financial asset rights based on the blockchain, it can enhance the point-to-point relationship between investors and borrowers in the financial process, and the operation efficiency of the financial market will be improved as a whole. This increases the scale of the direct financial market, that is, “one rise.”

This process may bring about the decline, focus and transformation of financial intermediary functions. In the future, financial intermediary functions will be mainly aimed at realizing the most important functions of investor and borrower transaction matching, information collection and analysis, that is, “one drop”.

Blockchain has a rising and falling impact on the financial market and financial intermediaries, which in turn may promote the innovative adjustment and improvement of financial systems and regulatory mechanisms, so as to maintain currency stability and financial stability under the background of this great opportunity. Three “Innovation”.

Today’s world has entered the bottom of the technology cycle, the top of the financial cycle, and the edge of the collapse of the international order. The sudden attack of the new crown epidemic has pierced the global asset bubble and the oil price. It is breaking the global order and bringing more uncertainty. To

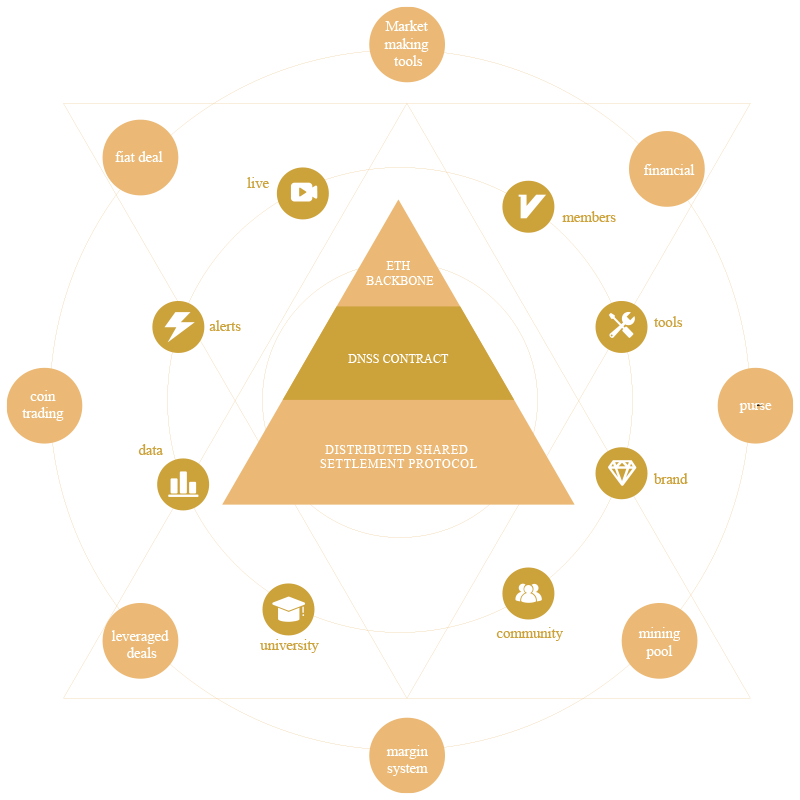

Distributed Number Shared Settlement (DNSS for short) was born for the reconstruction of chain interaction, finance, and global governance models. Based on the current and future financial, economic, institutional thinking and careful layout of human beings, it injects decentralized energy into the barbaric era of the shock period, and relies on the decentralized core to create a scientific, reliable and fair chain interaction with multiple guarantees. Smart contracts for mining, financial management, and settlement, incubating ecological application groups, allowing capital to serve all believers, and allowing assets that conform to the rules of the business game to increase in an orderly manner in fission. Give time to civilization, not to civilization. Every age has every shackle, and there are also feats that drive the wheels of every age.

DNSS uses a decentralized logical structure to allow the smallest individuals to participate in the smart contract that drives the world to innovate, achieving that everyone is a believer, everyone is a participant, and everyone participates equally in the creation and redistribution of wealth. Lead all ordinary individuals to step out of the inter-epoch, and jointly develop a consensus and build an eternal country of common prosperity.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No A News Week journalist was involved in the writing and production of this article.